The Investment Company Institute reports that there is roughly $7.9 trillion in Individual Retirement Accounts (IRA).1 To help put that in perspective, that’s nearly half the annual gross domestic product of the U.S.2

If you have a traditional IRA, you may have the opportunity to stretch it out, meaning the account may be structured to extend its tax-deferred status across multiple generations.3

With a traditional IRA, the account holder must begin taking required minimum distributions (RMDs) by April 1 of the year after he or she turns 70½. These payments are based on the IRS’ tables for life expectancy. To calculate an RMD, divide the account balance by the account holder’s anticipated lifespan.

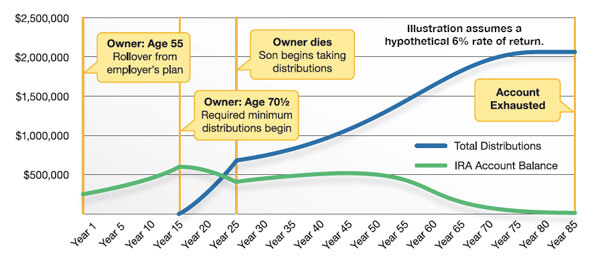

Case Study

Let’s assume, for example, a 73-year-old has an IRA with a balance of $250,000. According to the Internal Revenue Service’s 2017 lifespan table, the person’s life expectancy is 14.8 years, so the RMD is:

$250,000 ÷ 14.8 = $16,891.89

At that rate, it may take several years to deplete the account — in some cases, longer than the account owner is likely to be alive. So what are your options?

First, you can name your spouse as beneficiary of the traditional IRA, and he or she can roll the balance into a new account. If your spouse is over age 70½ when you die, he or she must begin taking RMDs based on his or her life expectancy. When your spouse dies, the second-generation beneficiary may transfer the balance into an inherited IRA. Then, the owner of the inherited IRA must begin taking RMDs based on his or her life expectancy. (See illustration.)

This gives the money in the inherited IRA a longer time to remain tax deferred. Keep in mind, however, that there is no guarantee that the person who inherited the IRA will continue the tax-deferred treatment of the account.

How About a Roth IRA?

Stretching a Roth IRA follows similar rules to a traditional IRA. But remember, a Roth IRA does not require any RMDs. If you name your spouse as a beneficiary, he or she can roll the balance into a new Roth account. Since it remains a Roth IRA, your spouse is not required to take RMDs either. When your spouse passes, the beneficiary must begin taking distributions. The distributions will be tax free since it’s a Roth IRA.4

Stretching an IRA can be a powerful strategy. But it’s critical to understand the limitations and benefits before following the approach.

How Does it Work?

A single father, age 55, rolls over $250,000 from his employer’s retirement plan into a traditional IRA and names his son, age 25, as beneficiary. At age 70½, the account owner starts taking RMDs.

When he dies at age 80, his son moves the assets into an inherited IRA and starts taking RMDs based on his life expectancy.

By the time it’s exhausted, the IRA will have lasted 85 years and paid out over $2 million in benefits — all from a $250,000 rollover.

This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments. Past performance does not guarantee future results. Actual results will vary.

![]()

Tip: What’s in a Name? If you fail to name a beneficiary on your IRA, it may be much more difficult for your beneficiaries to ‘stretch’ the inherited IRA over their lifetimes.

Tip: What’s in a Name? If you fail to name a beneficiary on your IRA, it may be much more difficult for your beneficiaries to ‘stretch’ the inherited IRA over their lifetimes.

Fast Fact: Inheritance. The IRS rules that allow a stretch IRA are the rules under which one inherits an IRA. This is why stretch IRAs are sometimes referred to as “inherited IRAs.”

Fast Fact: Inheritance. The IRS rules that allow a stretch IRA are the rules under which one inherits an IRA. This is why stretch IRAs are sometimes referred to as “inherited IRAs.”

Source: Internal Revenue Service, 2017

- Investment Company Institute, 2017

- CIA World Factbook, 2017

- Contributions to a traditional IRA may be fully or partially deductible, depending on your individual circumstance. Distributions from traditional IRAs and most other employer–sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.

- To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawals also can be taken under certain other circumstances, such as a result of the owner’s death. The Tax Cuts and Jobs Act of 2017 eliminated the ability to “undo” a Roth conversion.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2019 FMG Suite.