In 2014, the country witnessed the historic appointment of Janet Yellen as Chair of the Board of Governors of the Federal Reserve System. She became the first woman to take the helm of the world’s most influential central bank.¹ She and the Fed governors are tasked with adjusting short-term interest rates to help control inflation in an effort to promote overall economic growth.

In recent years, inflation has remained low, which has allowed the Fed to maintain record-low short-term interest rates. But some are concerned that the Fed’s interest-rate policy may accelerate inflation in the future, and they are looking for investment opportunities that have the potential to react to higher interest rates.

A Few TIPS

Unlike conventional U.S. Treasury bonds, the principal amount of Treasury Inflation-Protected Securities, or “TIPS,” is adjusted when there are changes in the Consumer Price Index (CPI), which measures changes in inflation. When the CPI increases, a TIPS’ principal increases. If the CPI falls, the principal is reduced.

The relationship between TIPS and the CPI can affect the amount of interest you are paid every six months and the amount you are paid when your TIPS matures.²

Remember, TIPS pay a fixed rate of interest. Since the fixed rate is applied to the adjusted principal, interest payments can vary from one period to the next.

When TIPS mature, the bondholder will receive either the adjusted principal or the original principal, whichever is greater.²,³

If you are concerned about inflation—and expect short-term interest rates may increase—TIPS are an investment that may be worth considering. A close review of your overall strategy also might reveal other investment choices that may be appropriate in an environment of changing interest rates.

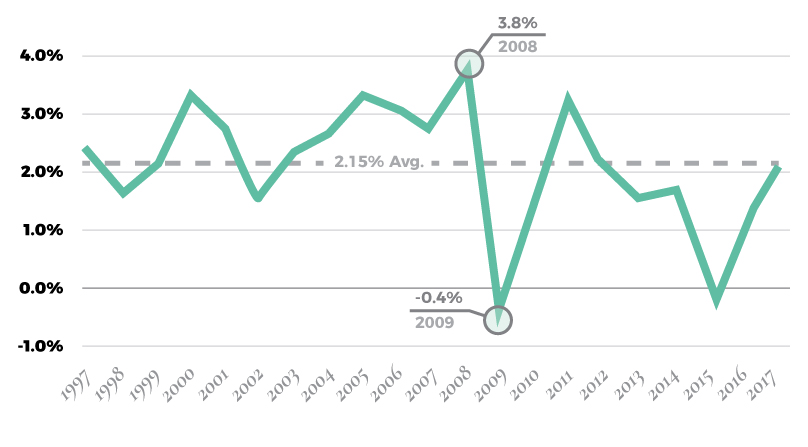

Inflation in Perspective

In recent years, the Consumer Price Index has bounced below 2.15%, its average rate for the past 20 years.

![]()

Tip: The twice-yearly inflation adjustments to TIPS are considered taxable income even though investors won’t see that money until they sell the bond or it reaches maturity.

Tip: The twice-yearly inflation adjustments to TIPS are considered taxable income even though investors won’t see that money until they sell the bond or it reaches maturity.

Source: U.S. Treasury, 2017

Fast Fact: What Are the Terms? TIPS are issued in terms of 5, 10, and 30 years.

Fast Fact: What Are the Terms? TIPS are issued in terms of 5, 10, and 30 years.

Source: U.S. Treasury, 2017

- Board of Governors of the Federal Reserve, 2017

- The interest income from a Treasury Inflation-Protected Security (TIPS) is exempt from state and local taxes. However, according to current tax law, it is subjected to federal income tax. Adjustments in principal are taxed as interest in the year the adjustment occurs even though the principal adjustment is not received by the bondholder until maturity. Individuals should consider their ability to pay the current taxes before investing.

- TreasuryDirect.gov, 2017

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2019 FMG Suite.