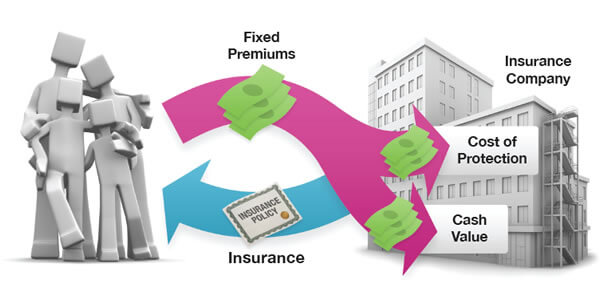

Whole life insurance remains in force for your whole life, as long as you remain current with your premiums.

In exchange for fixed premiums, the insurance company promises to pay a set benefit when the policyholder dies. Whole life insurance policies build up cash value — effectively a cash reserve that pays a modest rate of return. This growth is tax deferred. Guarantees are based on the claims-paying ability of the issuing company.

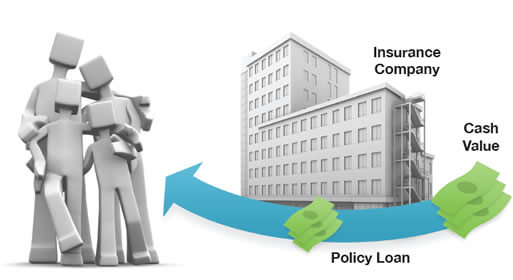

Most whole life insurance policies will let policyholders borrow a portion of their policy’s cash value under fairly favorable terms. And interest payments on policy loans go directly back into the policy’s cash value.*

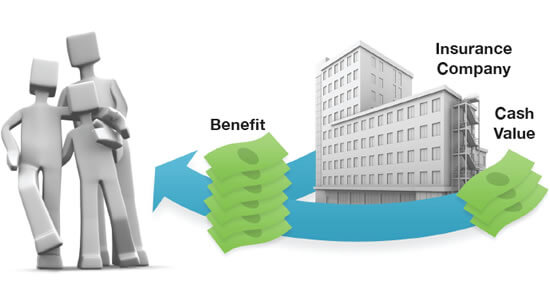

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. Depending on how the policy is structured, benefits may or may not be taxable.

*Whether whole life insurance is the best choice for you will depend on a variety of factors, including your unique goals, needs, and circumstances. Understanding how a whole life insurance policy works will enable you to make an intelligent, informed choice.

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments. Life insurance is not FDIC insured. It is not insured by any federal government agency or bank or savings association.

Generally, loans taken from a policy will be free of current income taxes, provided certain conditions are met, such as the policy does not lapse or mature. Keep in mind that loans and withdrawals reduce the policy’s cash value and death benefit. Loans also increase the possibility that the policy may lapse. If the policy lapses, matures, or is surrendered, the loan balance will be considered a distribution and will be taxable.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2019 FMG Suite.